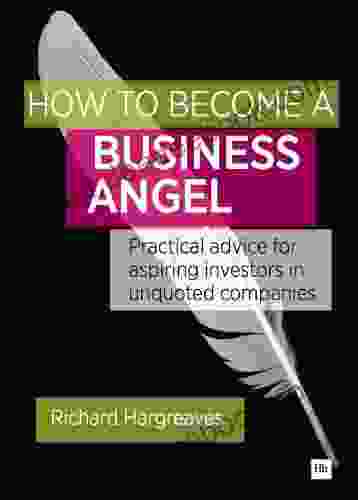

Practical Advice for Aspiring Investors in Unquoted Companies

Investing in unquoted companies can be a great way to generate wealth, but it's important to do your research and understand the risks involved. This article provides practical advice for aspiring investors in unquoted companies, including how to find and evaluate investment opportunities, how to structure your investment, and how to manage your risk.

4.5 out of 5

| Language | : | English |

| File size | : | 1146 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |

How to Find and Evaluate Investment Opportunities

The first step to investing in unquoted companies is to find and evaluate investment opportunities. There are a number of ways to do this, including:

- Attending industry events and conferences. This is a great way to meet company founders and executives, and to learn about new investment opportunities.

- Networking with other investors. Talk to other investors who have experience investing in unquoted companies. They can provide you with valuable insights and s.

- Reading industry publications and research reports. This can help you to stay up-to-date on the latest trends and developments in the unquoted company market.

- Using online platforms. There are a number of online platforms that connect investors with unquoted companies. These platforms can be a great way to find and research investment opportunities.

Once you have identified a potential investment opportunity, it is important to evaluate the company carefully. This includes:

- Reviewing the company's financial statements. This will give you a good understanding of the company's financial health and performance.

- Talking to the company's management team. This will give you a chance to assess the team's experience and vision for the company.

- Visiting the company's operations. This will give you a first-hand look at the company's business and operations.

- Getting references from other investors. This will help you to gauge the company's reputation and track record.

How to Structure Your Investment

Once you have evaluated a potential investment opportunity and decided to invest, the next step is to structure your investment. There are a number of different ways to do this, including:

- Equity investment. This is the most common type of investment in unquoted companies. Equity investors receive a share of the company's ownership in exchange for their investment.

- Debt investment. This type of investment involves lending money to a company in exchange for interest payments. Debt investors do not receive ownership of the company, but they have a claim on the company's assets in the event of a default.

- Convertible debt investment. This type of investment is a hybrid of equity and debt. Convertible debt investors receive interest payments on their investment, and they have the option to convert their debt into equity at a later date.

The type of investment structure that you choose will depend on your investment goals and risk tolerance. If you are looking for a high-return investment with the potential for capital appreciation, then an equity investment may be a good option. If you are looking for a more conservative investment with a lower risk of loss, then a debt investment may be a better choice.

How to Manage Your Risk

Investing in unquoted companies can be a risky investment. There is always the potential for the company to fail, and you may lose your investment. However, there are a number of things you can do to manage your risk, including:

- Diversifying your portfolio. Don't put all of your eggs in one basket. Invest in a number of different unquoted companies, so that you are not overly exposed to the risk of any one company failing.

- Investing only what you can afford to lose. Don't invest more money than you can afford to lose. This will help you to protect your financial security in the event of a loss.

- Understanding the risks involved. Make sure you understand the risks involved in investing in unquoted companies before you invest. This will help you to make informed decisions about your investments.

Investing in unquoted companies can be a great way to generate wealth, but it's important to do your research and understand the risks involved. By following the advice in this article, you can increase your chances of success as an investor in unquoted companies.

4.5 out of 5

| Language | : | English |

| File size | : | 1146 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Page

Page Text

Text Story

Story Library

Library Magazine

Magazine Newspaper

Newspaper Glossary

Glossary Synopsis

Synopsis Annotation

Annotation Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Encyclopedia

Encyclopedia Narrator

Narrator Character

Character Librarian

Librarian Catalog

Catalog Card Catalog

Card Catalog Borrowing

Borrowing Archives

Archives Periodicals

Periodicals Research

Research Scholarly

Scholarly Lending

Lending Reserve

Reserve Reading Room

Reading Room Rare Books

Rare Books Study Group

Study Group Dissertation

Dissertation Storytelling

Storytelling Reading List

Reading List Theory

Theory Textbooks

Textbooks Robert Louis Caldwell

Robert Louis Caldwell Collins Easy Learning

Collins Easy Learning Kal Spriggs

Kal Spriggs Nicole Gonzalez Van Cleve

Nicole Gonzalez Van Cleve William Perry Pendley

William Perry Pendley Celia Anderson

Celia Anderson Jeff A Menges

Jeff A Menges Michael P Dombeck

Michael P Dombeck Linda Mason

Linda Mason Geoff England

Geoff England Marsha List Konz

Marsha List Konz Brigadier General Y S

Brigadier General Y S Nick Vaughan Williams

Nick Vaughan Williams Rolle W

Rolle W Howexpert

Howexpert Fiona Gribbon

Fiona Gribbon Claude Bernardin

Claude Bernardin Ray Mcpadden

Ray Mcpadden Mario Calabresi

Mario Calabresi Benjamin T Smith

Benjamin T Smith

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Heath PowellFollow ·6.9k

Heath PowellFollow ·6.9k Roland HayesFollow ·9.8k

Roland HayesFollow ·9.8k Leon FosterFollow ·12.7k

Leon FosterFollow ·12.7k Carlos DrummondFollow ·11.8k

Carlos DrummondFollow ·11.8k Keith CoxFollow ·19.1k

Keith CoxFollow ·19.1k Pete BlairFollow ·16.1k

Pete BlairFollow ·16.1k Jedidiah HayesFollow ·4.7k

Jedidiah HayesFollow ·4.7k Milan KunderaFollow ·2.9k

Milan KunderaFollow ·2.9k

Timothy Ward

Timothy WardThe Rise of the Sharing Economy: A Transformative Force...

The sharing economy, a revolutionary...

D'Angelo Carter

D'Angelo CarterMidsummer Night's Dream: Maxnotes Literature Guides

Midsummer...

Ralph Ellison

Ralph EllisonThe Alice Stories: Our Australian Girl

The Alice Stories...

Jayson Powell

Jayson PowellThe Enigmatic Rhythmic Gestures in Mozart's Music:...

Wolfgang Amadeus...

4.5 out of 5

| Language | : | English |

| File size | : | 1146 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 312 pages |